Trust-Based Estate Plan

Safeguard your legacy and simplify the process.

A Trust-Based Estate Plan offers the most effective way to protect your loved ones and your assets. Here's how it streamlines your wishes:

Seamless Asset Transfer: Avoid probate court delays and ensure your assets pass directly to your beneficiaries, minimizing stress for your family during a difficult time.

Customized Peace of Mind: Our state-specific plans are tailored to your needs, allowing you to nominate guardians for your children, clearly list your assets, and outline your wishes for medical emergencies.

Complete Confidence: With everything documented and organized, you can rest assured your loved ones will be taken care of exactly as you intend.

BENEFITS:

Care for your loved ones: Nominate guardians for your children and pets, ensuring their well-being.

Reduce stress: Appoint a trusted person to handle your affairs, relieving your family of burdens during a difficult time.

Personalize your legacy: Leave specific gifts to cherished individuals, creating lasting memories.

Plan your distribution: Clearly outline how your assets will be distributed, avoiding confusion and potential conflict.

Protect your wishes: Exclude individuals from inheriting your property, ensuring your wishes are followed.

Plan your final wishes: Specify your preferences for your funeral and other arrangements, honoring your wishes and easing the burden on your family.

Make your voice heard: Include any special requests you have, ensuring your individuality is remembered.

Prepare for emergencies: Decide what medical care you want in an emergency, giving your loved ones guidance and peace of mind.

Empower your healthcare team: Designate healthcare agents to make medical decisions if you can't, ensuring your wishes are carried out.

Share medical information: Grant trusted individuals access to your medical records, facilitating smooth communication with your healthcare providers.

Set conditions (optional): Attach conditions to asset distributions, providing guidance on how you'd like your beneficiaries to use your gifts.

Avoid probate hassle: Bypass probate court, ensuring a smoother and faster distribution of your assets to your beneficiaries.

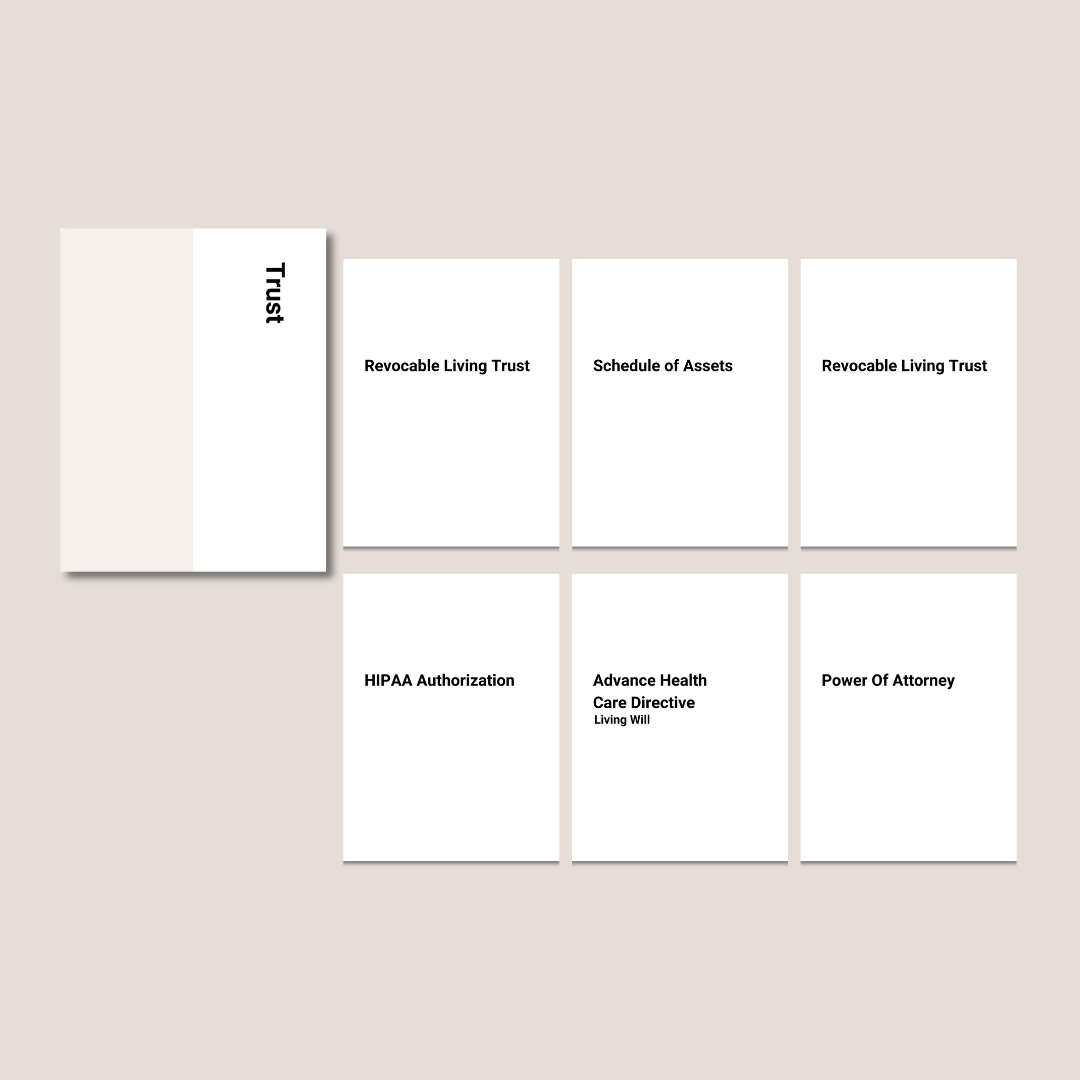

DOCUMENTS:

Revocable Living Trust: This trust manages, controls, and distributes your assets during your lifetime and after your passing. You can easily update it as your circumstances change.

Schedule of Assets: This essential list details all the assets held within your trust, simplifying tracking and management.

Pour-Over Will: This will complement your trust by ensuring any assets unintentionally left outside the trust are ultimately directed to it for distribution according to your wishes.

HIPAA Authorization: This document empowers trusted individuals to access your medical information when needed, ensuring smooth communication with healthcare providers.

Living Will (Advance Directive): This document outlines your preferences for medical care if you are ever unable to make decisions, guiding your healthcare team and respecting your wishes.

Power of Attorney: This document assigns a trusted person (your agent) to manage your personal and financial affairs if you are incapacitated or unavailable.

Certification of Trust: This document, shared with third parties instead of your full trust, summarizes key provisions without revealing private details.